2021 MEDIA ADVERTISING FORECAST

This month our very own media guru and resident Research and Strategy Director, Steve Allen, predicts how advertising spend will pan out over 2021. Steve spends a lot of time measuring and calculating the Media markets, not merely because it is the business sector we are in but far more importantly because it tells us and our Clients what market conditions they will face. Demand and supply cascade into pricing, which can be highly variable as Media change their selling and pricing policies constantly, based on both forecasts and demand (and/or fill)

2020 was a year of two halves from Media & Marketing perspectives. In the first half of 2020 Media Revenue was down 24% based on SMI figures, the biggest drop in 50+ years of tracking. The second half decline was only a little over 7%. This, and more recent SMI data, points to Australian advertising spend recovering from Covid-19 far more rapidly than first expected. As is the case for the Australian economy and quicker than pretty much all westernised developed economies.

There is no doubt Government stimulus programs, particularly Job Keeper and Job Seeker, have played a very large role in this recovery and momentum. On SMI figures, 2020 finished 15% down in Media Advertising revenue, well below many forecasts. Digital fared best and was just 2.5% down in 2020, while Television was next best / worst at -12%. All other media were down 20%+ with Cinema, Magazines & Outdoor getting smashed in 2020.

Steve forecasts 2021 SMI figures to be up 12% YOY which would still be around 5% below 2019 SMI estimates. To date in 2021 SMI has January -3.1%, February -2.6% and for March Steve estimates at +7% result. Although Q1 is behind Steve’s 2021 forecast, in our dealings with the Media, Q2 has definitely picked up strongly in many media sectors.

SMI is media agency expenditure and therefore does not include clients booking direct. As a very rough guide, SMI covers around 50% of all spend and around 80% of most media’s advertising income however vastly under estimates Digital. Due to the enormous long tail of bookings by smaller clients it is hard to determine what is spent on Google and Facebook. Steve’s 2021 forecast for expenditure and share for the “entire market” is as follows;

| Rank | Media | Ad spend Growth | Share |

| 1 | Digital | +5.5% | 61% |

| 2 | Television | +3.8% | 22% |

| 3 | Radio | +20.5% | 7% |

| 4 | Outdoor | +42.9% | 5% |

| 5 | Newspapers | -16.4% | 3% |

| 6 | PayTV | +4.2% | 2% |

| 7 | Magazines | +19.4% | 1% |

| 8 | Cinema | +120% | >1% |

The rest of the economy is already firing up. Economic recovery is strong, ahead of nearly all predictions, surprising on the upside with nearly every monthly release of economic indicators; Employment, Retail Sales, On Line Sales, December HY trading and profit results, savings, Credit card debt etc. This raft of performance indicators should be underpinning a much larger lift in Advertising support.

There is also a huge opportunity for clients to invest in advertising particularly if their competitors are not. What better time to build market share if sales in your category are coming relatively easily?

WHAT’S NEW IN MEDIA – THE GROWTH OF AUDIO STREAMING

The rise of the smart speakers (think Google home, Sonos, etc) and smart phones has well and truly buried the old transistor or large stereo in the corner of a lounge room. This all means audio streaming is moving ahead fast. Today 9.4 Million Australians are streaming audio and projections show this will increase to 80% of all Australians by 2024.

The Radio networks naturally want to capitalise on this streaming and offer listeners the freedom to consume Radio, Music and Podcasts at their time of choosing. ARN launched their app (iHeart) back in 2013 and SCA has now just launched their ‘Listnr’ app. Nova will also be launching their app soon.

The apps allow the networks to connect ad exposure to real world behaviours and quantify the impact that audio has on in store visitation. The apps mimic industry giants like Spotify and Apple Music by attempting to deliver a curated audio experience which combines radio, podcasts, music, and audio news under the one roof.

From a customer point of view, the apps are based around finding people’s interests and likes and making suggestions for them based off what they listen to. From a client point of view, it is about creating an environment where it can build rich first party data that will allow advertisers to reach audiences across a broad range of audio assets on one platform.

Upon registration users are asked to provide their personal details and nominate interests which will allow the advertiser to audience target based on age, gender, ethnicity, geographical location, and device.

At present, it is estimated that Radio streaming could add 5-10% reach to a traditional Radio buy. So although it is still small numbers, it is growing and no doubt the Radio Networks see it as a way to capitalise on a digital future.

DIGITAL – ‘PARTY’ LIKE THERE’S NO TOMORROW

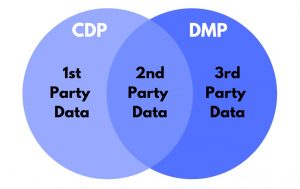

3rd party cookies are due to be phased out by 2022 and we can’t emphasise enough the importance of building your 1st party database. The future without 3rd party cookies is yet to be determined although many major publishers have released thoughts on what the new way to universally target unique consumers will look like in their eyes. At this stage, standpoints have varied and it is still the great unknown without a one size fits all solution. The three types of data for ad targeting across the internet of the future are;

Chrome privacy sandbox: Google’s solution is called the ‘Privacy Sandbox’. Google will generate audience segments where data is stored and processed in the Chrome browser. This will represent around 65% of the market. The data will be modelled with no user or device level data and is called FLoC also known as ‘Co-horts’. This is essentially fused data via machine learning on a group of individuals based on how they have behaved on sites and what content they have viewed. This is not built on an advertisers 1st party data, nor can you target individuals within a FLoC, you can use your data to determine which FLoC’s you want to reach. This will deliver a large scale of audience but perhaps less accurate.

Publisher 1st party data: Major publishers (Nine, News, etc) are looking to use their 1st party cookies to build user level data comprising people based and anonymous device data. The benefit the publishers have is their consumers sign in and are effectively giving permission to be tracked within their site. This will be highly accurate and deliver a decent scale but not to the size of Google. The missing piece of this puzzle, is we currently don’t have a solution to cross-pollinate audiences across publishers. There has been much discussion on exactly how users will be uniquely identified across the open web. Will it be an exchange of hashed email addresses? Will it be a phone number? Will there be an opt-in?

Identity based solutions: A direct relationship between the user, publisher & advertiser. Eg. Advertiser meshes their 1st party data with the publisher, who also has a 1st part relationship with the end user. This mesh data can be IP address, email, phone number.

The common theme on these points, is both as a publisher and an advertiser, you will need robust 1st party data to continue to have targeted digital ads from Jan 2022. Especially if your current strategies rely heavily on third party cookies.

From a programmatic perspective, we believe targeted advertising, and, re-targeting capabilities across a collective of sites will still be possible once there is clarity on the unified ID and private exchange of information.

For now, on the face of it and combined with what we already know, the latest Google announcement does mean, as both an advertiser, and as a publisher, never has it been more important to invest time, energy, and resource, into strengthening your 1-1 customer relationship, and ultimately your 1st party data.

SMI UPDATE – FEBRUARY 2021

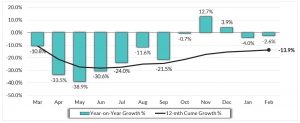

The media Agency market is heading in the right direction in February, reporting a -2.6% year-on-year decline to $557.9 million. However, given the huge declines in advertising spend from March–September 2020, there is little doubt that the next 6 months of SMI data will show positive year-on-year growth. It is also highly likely that FY21 will finish as a positive as it is now only back -5.8%. April-June 2020 were the months most affected by the Covid downturn.

Government advertising spend continued to help February 2021 and was up 60% while In-Home Entertainment was up 69%. Clearly the home related sectors have benefitted from these difficult times. But the overall recovery story was strongly underpinned by a small 0.1% year-on-year increase in Automotive Brand ad spend, it’s first in more than a year. It is promising to see positive movement in what was once the largest spending category

Television delivered the strongest growth (+8.6%) led by Metropolitan TV (+12%) which was buoyed by the delayed Australian Open broadcast. In comparison, Digital ad spend lifted just 1.2% this month and – like the broader market – also reported patchy demand with strong growth in ad spend to Social Media (+12.3%) and Video Sites (+12.7%). But the value of bookings to the largest sector of Search fell 8.4%. Patchy demand was also evident in Outdoor with the largest Posters/Billboards sector growing 9.1% and Retail Outdoor +1.2%. But Outdoor’s recovery is being hindered by large declines in bookings to the Aviation, Transit and Street Furniture sectors. Radio was down (-10.8%), Newspapers -23.4%, Magazines -48.2% and Cinema -70%.

FAST FACTS

- The Sydney Royal Easter Show was first held in 1823 and is Australia’s largest annual ticketed event

- house values surged by 2.8% in March – the fastest pace in 32 years!

- 4 million Australians viewed SVOD in an average week in Dec’20

- 9 billion people watched Prince Harry marry Megan Markle, 49.1 million watched their tell all with Oprah

- Today (7th April) is ‘National no housework day’ – put your feet up!