THE LIFESPAN OF BRANDS

An interesting topic given the news that Jeanswest (48 years old) and McWilliams Wines (141 years old) have recently gone into administration. Perhaps those brand names will carry on but there have certainly been some big names that no longer exist. Remember MySpace, Ansett, Grace Brothers, Pioneer, HIH Insurers, Cosmopolitan Magazine, Fairfax, Dick Smith and Gowings just to name a few.

In our own back yard, the advertising industry has not been great in maintaining their own brands. At one point George Patterson, J Walter Thompson, Leo Burnett, Lintas, Mitchells and Merchants ruled the Australian Advertising market.

Occasionally brand names get second lives. The Bank Of Melbourne was taken over by Westpac in 2004 who replaced the name (to Westpac) and then revived it back to Bank Of Melbourne in 2011. Caltex petrol stations have also recently announced they are rebranding back to Ampol after they killed the brand name back in 1995 when they merged.

Then there are the brands that have survived 100+ years such as Panasonic (started in 1918), Kikkoman (1917), Coca Cola (1886), GE (1892) and Fiskars that was founded in 1649. The record for the oldest brand name seems to be 1,400 years by a Japanese construction company called Kongo Gumi (founded 578) which unfortunately failed in 2006.

Brand names disappear for 3 main reasons, 1) they’re rebranded 2) they don’t embrace change or 3) they run into financial troubles.

Company takeovers are often the cause of a brand name changing such as Grace Bros becoming Myer or Fairfax becoming Nine. This often seems counterproductive given the time, effort and money it takes to build a brand that the population has an affinity with. Then there is the fact that the world is constantly changing, placing pressure on businesses to stay relevant. There have been many examples of market leading brand names that didn’t adapt to the new environment e.g. Blockbuster Video, Kodak film and Remington Typewriters. The third reason is a little more obvious when businesses get into financial difficulties due to numerous causes. Some companies don’t keep on top of accrued liabilities such as tax or get into trouble due to cashflow shortages. Of course, simply not having enough revenue to cover costs is always going to be a problem.

In 2020 Brands are under more pressure than ever as the average tenure of Chief Marketing Officers (the brand’s guardian) gets shorter each year. This means there are so many more people given the task of custodian across the brands lifespan.

The question of the lifespan of a brand is unfortunately a bit like how long is a piece of string? Brands survive when they a have a consistent, credible personality that creates and holds a relationship with a customer. Like all relationships, they must grow, develop and change meaning brands need to be flexible and willing to adapt to secure a longer lifespan.

‘VOZ’ – TV MEASUREMENT

The latest Television audience measurement tool in Australia is

due to be released in Feb 2020. “VOZ” will combine the audience for

Broadcast TV (viewing on a TV screen as the program goes to air) with the

audience of people watching TV programs either streaming or using catch up on

TV screens, laptops, phones & computers. The aim of VOZ is to deliver an all-screen,

de-duplicated picture of what Australians are watching, who is watching, and

how they are watching. This will enable clients to know their Reach &

Frequency across the numerous devices that TV is now watched on.

To determine the combined R&F and create a media profile of Australian

households and people, VOZ will combine the following data sources;

- television ratings currency panel data from over 12,000 individuals in OzTAM’s in-home broadcast TV measurement (TAM) sample;

- streaming television meter data from more than 1,300 TAM panel homes;

- online TV content viewed on 7 million connected devices (OzTAM’s Video Player Measurement service);

- population information from more than 50,000 establishment survey questionnaire responses per year for the TAM service; and,

- Australian Bureau of Statistics population data.

VOZ will allow us to better target viewers on both demographics (age, sex) as well as interests and needs (e.g., pet owners, mortgage-holders, frequent travellers, health conscious). It will also allow the overlay of external (first, second and third party) data sources to further support advanced audience targeting.

THE FRENEMY OF TRADITIONAL MEDIA

The WWW started out as one medium but ‘Digital’ is now

integral in every medium. It has been both a sinner and a saviour for

most media. Print was first to see ad revenue walk away as their audience

consumed digital news. Although now News Ltd’s digital ad revenue is around 2.3

times more than it is losing in print revenue based on SMI data. Magazines

don’t do as well and their digital ad sales are only delivering around 50% of

the ad revenue they are losing in their printed versions. The Outdoor medium

has probably gained the most as they embraced digital and converted many of

their hero sites to digital often costing north of $1mil to convert a single

road supersite. This has no doubt benefited outdoor and massively increased

their inventory (number of facings they can sell).

Television’s audience has fragmented however the networks have picked up

revenue from selling ads when people are viewing on digital devices. Digital

has also given them far greater audience targeting ability via BVOD (broadcast

video on demand). It is a bit harder to determine the digital effect on Radio.

Digital has allowed Radio to produce DAB+ niche stations such as coffeeFM,

buddha, etc and potentially they have affected ‘tradional’ listening by around

10-15%. Spotify and its ilk seem to have replaced albums, cassette tapes and

CDs with less affect on mainstream listening. Podcast listening is now

around 15 minutes a day and mostly for the under 40.

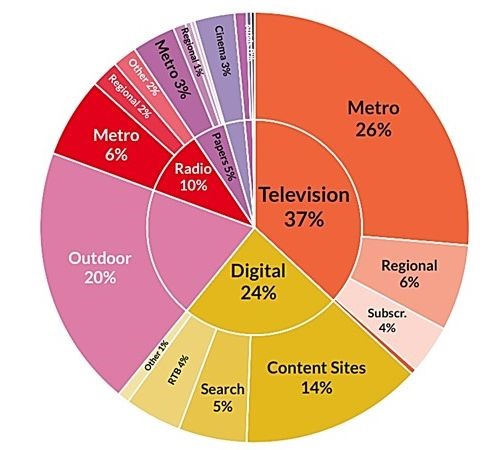

SMI UPDATE – DECEMBER 2019

The “interim” December figures have just been released and unfortunately the figures don’t look great. Once December is finalised it is reasonable to assume the annual (Jan-Dec) advertising pie that SMI measures will be around $6.8 billion. We have to go back to 2014 the last time SMI reported an annual figure below $7 billion. This means the 2019 advertising market will be around -6% compared to 2018.

Once again, Outdoor is the best performer in December with a record December month of $83 million which is up slightly on Dec’18. Digital spending continues to plateau albeit off a very large base.

There is no doubt that 2019 will go down as a bad year for most media on a comparative year to year basis with record decreases in ad spend. Television will be down around -7%, Digital down approx. -1%, Outdoor approx. -3%, Radio around -6%, Cinema about -5%, Newspapers down -16% and Magazines around -17%. The reduction in the Automotive, Retail and Gambling categories contributes around about 30% of reduced spend.

FAST FACTS

1. Watches are always set to 10:10 in ads because it frames the brand name and supposedly the watch looks happier

2. 2019 was the second warmest year on record since 1880. The warmest year to date was 2016.

3. The world’s most expensive ad is believed to have been $33 million spent by Chanel in 2004 with Nicole Kidman and directored by Baz Lurhrmann for a 2 minute ad. https://www.youtube.com/watch?v=yTO4FHf8MBs

4. Bushfire donations are fast approaching half a billion dollars – possibly Australia’s biggest fundraise

5. Mark Edmonson was the last Aussie male to win the Australian Open back in 1976. He wore a pair of Dunlop Volleys and beat John Newcombe.