GREED IS GOOD, GREED IS RIGHT, GREED WORKS!

That was Gordon Gecko’s motivation (from ‘Wall Street’) to convince shareholders that his way was going to put cold hard cash into their pockets. It could be suggested not a lot has changed since that 1987 movie with ‘share price’ being the main and most compelling measure of a company’s success. Share prices now make the nightly news and are relied upon by tens of millions of investors, especially retirees looking for dividends. Companies also rely on their share price to raise capital when issuing more shares. Perhaps the biggest driving force for a high share price is many senior management positions have stock options based on the performance of their company’s share price. Unfortunately, stock options can cause management to focus on short-term performance or to manipulate numbers to meet targets.

So where do the people who make the profit (aka the employees) rank compared to the share price? Sadly, the answer is probably not too high. Companies obviously need to ensure they are financially healthy to keep employees in jobs but how much profit is enough? It seems the system we have puts enormous pressure on CEOs, CFOs, and other corporate leaders to move heaven and earth to keep their share price high.

The “triple bottom line” (TBL) was coined in 1994 and aims to measure the financial, social, and environmental performance of a company. The three elements being profit, people and the planet. The idea is a company can be managed in a way that not only earns financial profits, but which also improves people’s lives and the planet.

The TBL seems to have come in and out of vogue and only for a short period become mainstream. For independent companies, with a handful of shareholders, it is probably easier to put the TBL in place. For listed companies, the only hope are the investment firms that control enough of a company to ensure management take notice. Interestingly the world’s largest investment firm, BlackRock, seems to have done that recently. BlackRock have $10 trillion in assets under management (yes, trillion) and has put climate change at the centre of its investment strategy. They have said they will abandon companies heavily invested in thermal coal and demand that companies report their exposure to climate change risks, their contribution to emissions and their plans to reduce them. In Australia, the $52 billion HESTA super fund has also divested holdings in thermal coal companies.

It’s great to see large investment firms looking after the planet although wouldn’t it be fantastic if employees were prominent in the triple bottom line as well. Companies rarely grow on the back of unhappy employees. It’s the commitment and talent of employees that power most successful companies. Any good manager knows staff motivation is crucial in the financial health of a company. This is particularly relevant to acknowledge today given the number of retrenchments in the news of late.

Naturally companies need to be profitable although a sole focus on the P&L or balance sheet must surely breed more Gordon Geckos. What a wonderful world it would be if all companies adopted the triple bottom line so that staff and the planet are also looked after!

WHAT’S NEW IN MEDIA – CINEMA IS BACK TODAY

Around 80% of cinemas are opening today (Thu 2nd July) in time for school holidays. The initial movies will be a mix of recently released movies and classics (eg. Harry Potter) along with reduced pricing.

After July there will be many blockbuster movies crammed into 5 months from Aug-Dec’20 that were due to be released pre-covid 2020. Some of the big movies coming our way are Tenet (13th Aug), Mulan (20th Aug), Wonder Woman 1984, Bond ‘No Time to Die’, Black Widow and Top Gun Maverick.

The audiences are anticipated to be 50% of Pre-Covid averages across the Jul – Sep quarter and then returning to 85% during the Oct – Dec quarter. Interestingly NZ has been re-opening for the last 6 weeks with 95% of Cinemas open and audiences have been growing at an average of +73% week on week over this time.

DIGITAL – AMAZON, SHE’S GETTING BIGGER & STRONGER IN AUSTRALIA!

Amazon started life as a book reseller and now sells virtually anything online. While many companies are still coming to terms with the impact Covid-19 has played on their industry, the American giant continues to slowly but surely cement themselves throughout the digital advertising marketplace.

In the US, Amazon now receives around $12 billion p.a. of the digital advertising spend. They sit only behind the digital ‘duopoly’ of Google and Facebook. Their increased presence in the US market doesn’t stop there as many surveys have shown that the site is number one for product specific searches throughout the US, with up to 55% of consumers saying they still start a product search on Amazon.

Having only just started in Australia a few years ago, Amazon doesn’t quite have the same presence they do in the US, but they are slowly starting to get a foothold across the Australian retail market. Over the last 6 months the Australian site has seen around 26.5 million visits. Recently, Amazon has also announced a $500 million investment in a new Western Sydney distribution centre that will house around 11 million different products. This should go a long way to increase their delivery speeds.

With an increase in fulfilment centres and the introduction of Amazon Prime, the company is looking to drive more consumers to the site and become the ‘one stop shop’ for online retail products. Something that is not currently seen in the Australian retail market. As Amazon’s market share increases throughout the Australian digital landscape more opportunities for advertisers will follow from a bigger database of consumer habits.

SMI UPDATE – MAY 2020

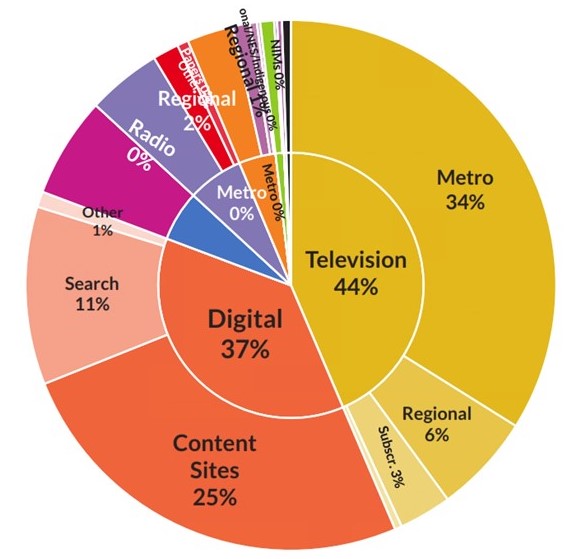

The latest SMI figures show May’20 is down 40% compared to May’19 as the full impact of Covid is being felt. The early June figures also show a 40%+ decline in spend putting the industry on track to a record quarterly decline in Q2 (Apr-Jun) of about 43%. In dollar terms this decline represents a staggering $700 million loss of media investment or circa $70 million of potential media agency revenues. However, SMI’s data shows future demand returning to more typical levels in July and August.

Outdoor had another painful month with -71% while Radio was not far behind with -56%. Television was down -36% and Digital was -26%.

In this desolate environment, the only major product category reporting any growth is Domestic Banks with their total bookings up 6.2% in May. Among smaller categories there has also been growth in the In-Home Entertainment and Household Supplies categories. But unsurprisingly large categories such as Automotive Brand (-62%), Restaurants (-43%) and Clothing/Fashion Accessories (-76%) are reporting significant declines. And the Travel category, which in May 2019 was the market’s fifth largest, has slumped 92% to now sit in 30th position.

FAST FACTS

- It is physically impossible to lick your elbow…. did you just try to do it??

- Two-thirds of Aussie businesses have suffered a decrease in business revenue compared to last year, with more than three in every 10 estimating that drop to have exceeded 50 per cent. (ABS)

- In 2019, Denmark generated 50% of its electricity needs with solar and wind energy

- Low-income earners have been carrying the Australian economy on their backs since March. They continue to outspend high-income earners across both discretionary and essential spending. (Illion)

- New Zealand was the first country in the world to give all women the right to vote in 1893.