BUYING MEDIA – LITERALLY!

We all work in the media business but have you ever thought about investing in it? If you don’t have a lazy $1.1 billion hanging around to buy APN Outdoor (as JCDecaux did last year) then perhaps the share market is the next best thing.

Looking at the returns over the last 5 years there are no prizes for guessing that anything Digital has achieved mammoth returns. If you bought Netflix shares in 2014 you would now be 430% richer on those shares. The Facebook share price has increased 155% and Google 135%. Closer to home, REA Group (realestate.com.au) achieved a 130% return and Carsales.com delivered 45% return. Surprisingly Domain Holdings, the digital property business founded by Fairfax, has had a 15% decline since it was listed in Nov’17.

The clear ‘share price’ winners from the ‘traditional’ media sector are the Outdoor companies. oOh!media realised a 52% return over the past 5 years although this would have been far greater had it not been for a downgrade in its FY19 profit forecasts. QMS also achieved a 65% return from its listing 4 ½ years ago thanks largely to Quadrant Private Equity recently wanting to acquire the business. The next best traditional performer over five years is News Limited with a 14% return and presumably their majority ownership in the REA Group has helped. If you had bought shares in any other traditional media such as Television (Seven West, Nine, Prime), Radio (SCA, HT&E), Cinema (Village Roadshow) or Direct Mail (Salmat) you would have unfortunately lost between 10-75% of your money since 2014.

The media that you can’t buy as they are privately owned include TEN (owned by CBS), WIN (Bruce Gordon), Nova (Lachlan Murdoch), JCDecaux and Bauer Media. QMS look to be soon joining this group.

Most of the media companies’ income is derived from advertising revenue so it is unsurprising their share prices are not overly strong at present due to the soft advertising market. The good news for media share investors is a general feeling that advertising spend will pick up in 2020.

CH7 PROGRAMS COMING IN 2020

The Seven Network seem to have the most to crow about for 2020 with more new programs, more revamping of old formats and the Tokyo Olympics across July & August. Their new programs include ‘Pooch Perfect’ hosted by Rebel Wilson – how can a show about people pandering their fur babies not rate? One potential rating hit could be ‘Mega Mini Golf’. Yes, Mini Golf! Think Mini Golf mixed with Ninja Warrior. They also have ‘SAS Who Dares Wins’ plus another cooking show called ‘Plate Of Origin’. The programs they are giving a second or third life to include ‘Farmer Wants a Wife’, ‘Royal Flying Doctor’ and ‘Big Brother’ – all previously on Nine or TEN.

SEARCH ENGINE MARKETING (SEM) – BEGINNERS GUIDE

SEM is often seen as the must use medium in any advertising campaign as you are bidding for people who are actively “in market” for your product. The good news about SEM is you only pay if someone clicks on your ad, the bad news is Google does not release the secrets to its algorithms for maximum impact. The algorithm determines where the ad will appear and takes into account many things including the amount of the bid, how optimised your website is, relevancy of the ad and clicking trends to date. Google clearly wants to maximise profits but needs to balance that with ensuring the consumer has a good experience.

To plan an SEM campaign we use the ‘Google Keyword Planner’ which shows a range of costs required for particular keywords or phrases. Each keyword or phrase will have different costs depending on how competitive the bidding for those words are. Constant monitoring responses for each keyword or phrase is crucial to stay on top of results, maintain the right bidding strategy and stay ahead of the point of diminishing returns.

To determine the amount that should be spent on SEM you would need to review the conversion rate from ‘click’ to ‘acquisition’ (albeit sales, website visits, etc). You can then determine what a reasonable amount to spend on each click would be and bid accordingly. Naturally SEM will always perform well for ROI as it is at the end of the marketing funnel and targets category buyers as opposed to sheer demographics. However, when clients are running high impact ad campaigns their SEM regularly performs a great deal better. Of course if you’re not happy with Google’s dominance you can always buy SEM on Bing however that only has around 3-5% of the Australian market.

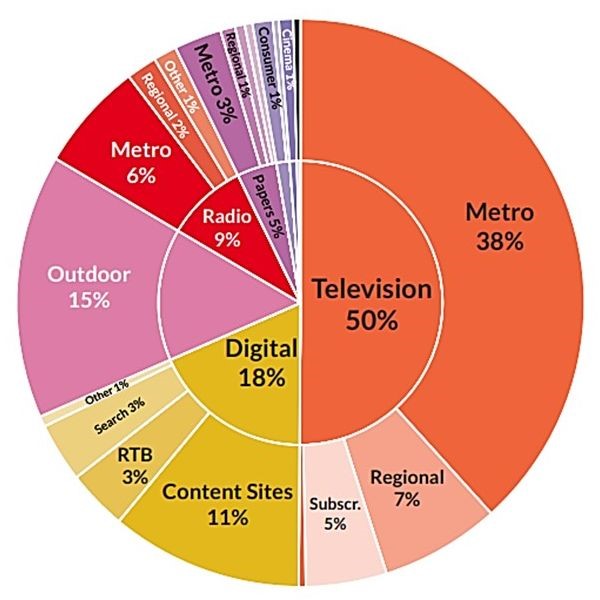

SMI UPDATE – OCTOBER 2019

The interim October results were released last Friday and are yet to show any signs of an advertising recovery. Excluding Digital (final results come in two weeks or so later) SMI’s early October figures show a 12.4% fall in Agency bookings compared to Oct’18. It is always dangerous to read too much into single month figures as major events or numbers of weeks in the month can affect the figures.

For the Jul-Oct19 period (FY20) vs STLY, Cinema is actually up 30% and Television is performing the next best but still at -6.5%. Although Outdoor and Radio have increased their ad revenue consistently over a number of years they are now showing -8.5% and -9.0% respectively for FY20.

The categories with the biggest declines in advertising expenditure for FY20 include Automotive (-$28mil), Banks (-$18mil) and Food (-$17mil) while the Insurance category (+$25mil) is helping minimise the overall advertising decline. The general consensus is for the ad market to improve in the second half of FY20 but unlikely to be sufficient to offset the downturn in the first half.

FAST FACTS

- Small businesses still owe the ATO $16.5 billion for FY19

- 50% of Australians have just 3.6% of national net wealth (Morgan wealth report)

- 2019 Melb Cup … yay or neigh

– TV viewing was down 27% vs 2018

– lowest attendance at Flemington since 1995

– betting was down approx. 6% - One in four small business owners intend to quit in 3 years (AMEX report)

- We know how to spend – Australian 2019 Christmas retail sales (12th Nov – 24th Dec) expected to grow 2.6% to $52.7 billion (Morgan / ARA)