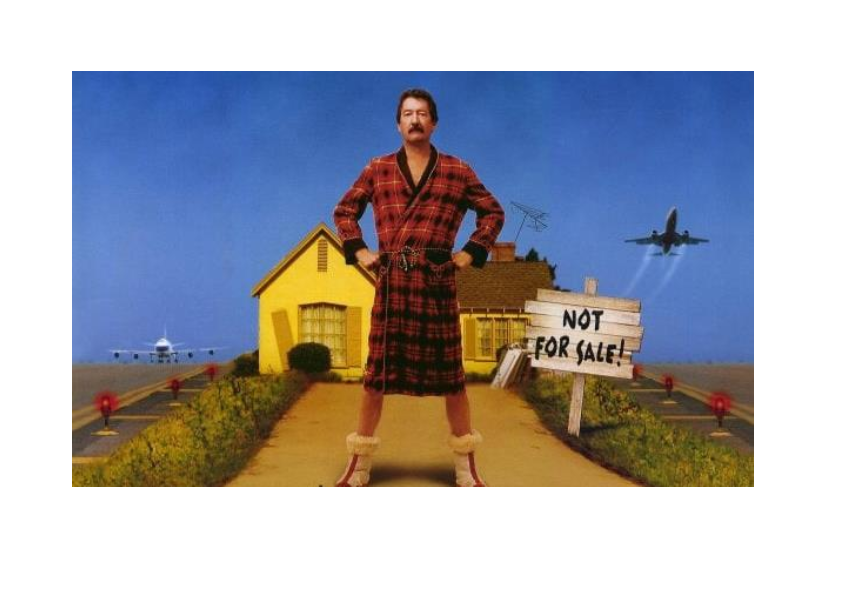

TELL HIM HE’S STREAMING!

It

could be argued Television viewing has changed even faster in the last 6 years

than ever before. The very definition of what it is to watch TV has been

challenged by the introduction of the streaming services which have now well

and truly infiltrated mainstream culture. The average user is consuming

approximately 10 hours of ‘streaming’ TV a week.

Watching Television via the internet on TV screens, phone apps, computers and

tablets has grown enormously in Australia as bandwidth has expanded and data

prices have come down. It began with the Government stations introducing

streaming catch up services for ABC iView in 2008 and SBS On Demand in 2011.

Network 10 introduced their catch up in 2013 (10 Play) and followed by 9Now and

7Plus a couple of years later. The giants of streaming TV, Netflix and

Stan, started in Australia in 2015 while Amazon Prime Video arrived in 2016.

In terms of paid streaming, Roy Morgan estimates around 55% of Aussies have

streaming services otherwise known as subscription video on demand

(SVOD).

Although paid streaming is increasing its footprint in the TV landscape,

Traditional TV still accounts for 46% of viewing while SVOD accounts for around

35%. The bad news for Traditional TV is SVOD viewing is growing and making it

harder to reach substantial audiences. This is also bad for advertisers as SVOD

is yet to carry advertising however the subscription model of revenue has

proven a struggle in what is a seriously competitive market. Netflix’s

debt continues to grow and at Jun’19 was around $24 billion (USD). We’ll say

that again, $24 billion!! They paid approximately $420 million in interest

alone in 2018. Without a continued increase in subscribers they could run

out of cash suggesting they may be forced at some point to incorporate

advertising onto their platform.

Foxtel joined the streaming revolution back in 2013 with the launch of Foxtel

Now which has now just been moved to the Foxtel Go app. As Foxtel

continues the battle against soaring sports broadcasting rights and pressure on

subscriber numbers they have also recently launched Kayo Sport as their

streaming sports platform. Since its introduction in November 2018, the

number of Kayo users has continued to grow with the latest figures revealing

331,000 subscribers nationally.

While Kayo seems to have sports streaming in Australia covered for now, regular

drama streaming is set for a big shake up. Apple TV+ is launching in

Australia on the 1st November at $7.99 per month and will be giving

buyers of an iPhone, iPad or Mac a free year of streaming. Apple is

reportedly prepared to spend billions of dollars to establish itself in the

market. Then there is the might of Disney that is coming to our shores on

the 19th November with the launch of Disney+ and its enormous amount

of in demand content.

Although these new entrants will continue to fragment TV audiences, streaming

could be highly beneficial to commercial TV with its ability to collect a great

deal more audience data and possibly deliver similar benefits to online advertising.

If all this choice is confusing and you’re desperate to find out the value of

Jousting Sticks we suggest you subscribe to Amazon Prime Video as they have The

Castle.

WHAT’S NEW IN THE MEDIA – FOXTEL

Foxtel

is probably under the most pressure today since their launch in Australia back

in 1995. The enormous competition from the streaming entrants for both

content and lower costs is clearly ramping up. They also lost the contract to

sell Network Ten advertising which they have had since 2015. CBS (Ch10’s

owner) wants to control their revenue and has therefore brought advertising

sales in house.

This may not be such a bad thing as previously Foxtel had a great deal of

trouble selling both Foxtel and Ten particularly given they were operating off

two different sales platforms. This allows Foxtel to concentrate on their own

product and in fact recently they’ve introduced two new sales

initiatives. We can now buy a 6 second ad as part of a “Q Break” on

Foxtel. The Q Break has a 3 sec intro (informing there is a quick ad

break coming), then two six-second ads at the end or start of a program. They

also introduced an “M Break” which is a one minute ad break with only two

advertisers.

Foxtel’s latest announcement is they are closing down their Digital Foxtel Now

platform and hoping to move people over to the Foxtel Go app.

DIGITAL UPDATE

DIGITAL PROGRAMMATIC – BEGINNERS GUIDE

Programmatic

Digital buying is a buying method that requires a highly sophisticated software

system to manage booking activity on numerous sites, serving the creative to

multiple locations and then paying each site based on its delivery. No

media agency owns this complex software however they use companies that do,

which are known as ‘Demand Side Platforms’ (DSPs). The term ‘Trade Desk’

means the agency buys direct with a DSP which is usually a benefit for clients

as there are less companies adding a service fee.

One of the main benefits of Programmatic activity is the ad placement is

optimised based on a particular interaction such as click through, conversion

on your site, etc all while the campaign is running. Programmatic advertising

has been attractive as it is seen as accountable and usually at a lower cost

than going direct to a particular site.

Unfortunately, in the early days, Programmatic was somewhat abused as some

buyers loaded up the Programmatic rates 100-400% and even at that rate it still

seemed reasonable to clients as it was delivering an accountable outcome

(compared to the higher prices of direct buys). Those days seem to have

gone as clients woke up to what was happening and some of the larger clients

took it in-house. These days clients can expect to pay 18-30% on top of any

Programmatic cost. Within the cost there should also be some “insurance”

costs built in to ensure the ads are viewable and verified (to prevent brand

risk or ad fraud).

SMI suggests digital programmatic spend is around 30% of all Digital

advertising. Programmatic ads can be either Display, Native, Audio or

Video. Interestingly, the Domain website now only accepts Display

advertising if it is booked Programmatically.

SMI UPDATE

The

interim August results are again showing a depressed advertising market. The

August results are showing the market to be back -16.6% although late Digital

bookings should reduce that figure substantially. When Digital is

excluded from the mix the decline from the remaining media is a lesser 10.1%.

All major media are also again reporting lower ad spend so far this month, with

Outdoor back 15.4% after growing a whopping 22% in August last year.

At this early stage SMI is reporting growth from only eight of the 41 product

categories with very significant declines in ad spend seen for Domestic Banks

(so far back 28.9%), Gambling (back 29%) and Retail (-21%).

Over the calendar year the Agency market is back 6.4% from last year’s record

level of $4.6 billion, representing a fall of $298 million.

FAST FACTS

- From 2020 Newsagents will no longer be home delivering newspapers. News & Nine have organised their own distributors to do it

- According to IPSOS – Professions considered untrustworthy by Australians: Politicians (64%), Advertising Executives (55%), Bankers (52%) and Clergy/Priests (42%)

- Dogs vs Cats? 38.7% of Aussies own a dog, 23.6% own a cat

- We all get a free 7 day trial of Apple TV+ from 1st November

- Australia’s longest-running newspaper is the Sydney Morning Herald, first published as the Sydney Herald in 1831

- The median income of the ASX 100 company bosses is $4.5 million a year … how do you get one of those jobs?