AUDIENCE FRAGMENTATION

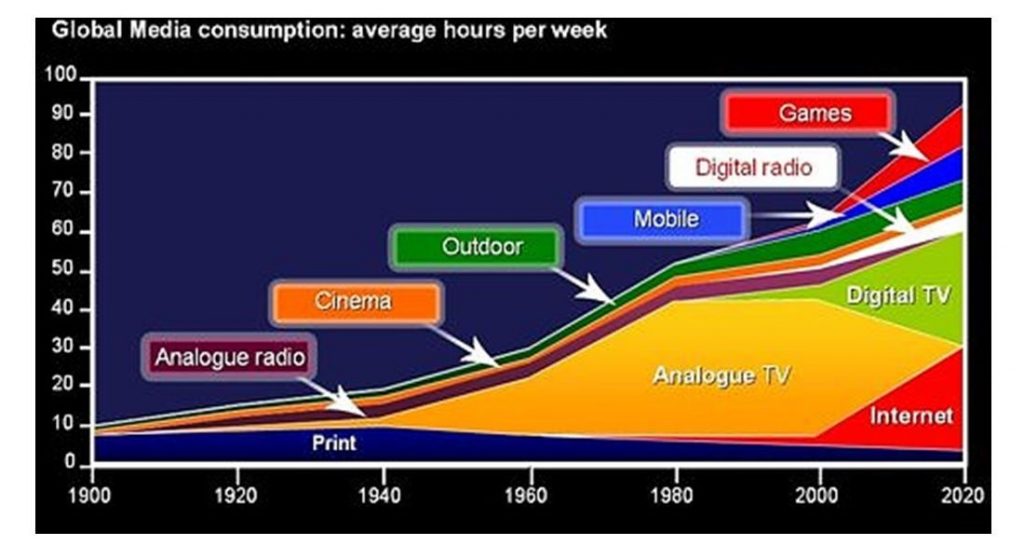

The fragmentation of

consumers’ media consumption over the last 20 or so years has made it more

difficult to reach the masses although has helped in terms of targeting

specific audiences. Perhaps fragmentation has been a curse to mass market

advertisers while possibly helping smaller niche targeting clients.

Stepping back into the mid-1990s Australians only had 5 TV stations (ABC, SBS,

7, 9 &10) to watch. No wonder the average audience of the top 10 programs

across the 5 capital cities was over two million per show. Then along came

PayTV (1995), the free to air digital stations, catch up TV, streaming,

Netflix, Stan and suddenly consumers can watch what they want, when they want

across a multitude of channels. Today’s highest rating TV show is lucky to get over

one million viewers.

Magazine’s readership is now fragmented across their print, App and web

editions. The mass women’s magazines printed versions have had a huge drop.

From 1999 to now, Womens Weekly (AWW) print readers went from 2.9 million per

issue down to 1.3 million per issue, Woman’s Day went from 2.6 million to

877,000 and New Idea went from 2.2 million to 785,000. Considering their total

audience including digital readers, AWW’s total readers are down 13% compared

to 1999, Woman’s Day total readers are 53% less than 20 years ago, and New Idea

is 50% less. In addition to this, the advertising is sold separately i.e. print

or digital. Again, massive fragmentation of the audience.

In the Newspaper glory days (circa 1997), they received over 50% of all

advertising spend while today they get a little over 4% of all spend. The

readership of the printed national papers (The Australian & the AFR) have

declined by 30-40% while the metropolitan papers print readership has declined

by over 60%. Naturally the papers do quite well with their digital copies

however total combined (print & digital) daily readership is still down by

around 25% compared to 20 years ago. Advertising is again sold separately as

print or digital which again fragments the audience for advertisers.

Radio listening has fragmented with the introduction of the numerous Digital

stations, Spotify and podcasts. Even Cinema have fragmented their audience as

there were a little over 1,000 screens in 1997 whilst today there are over

2,300 screens. Nonetheless ticket sales have remained relatively constant over

this time.

The one medium that has grown from zero consumption in 1995 to virtually

everyone today is the internet. Although the internet itself is massively

fragmented as it is all the traditional mediums plus over a billion websites

plus all the social sites. Australians spend up to 14 hours a week on social

media alone excluding time spent online with other media sites.

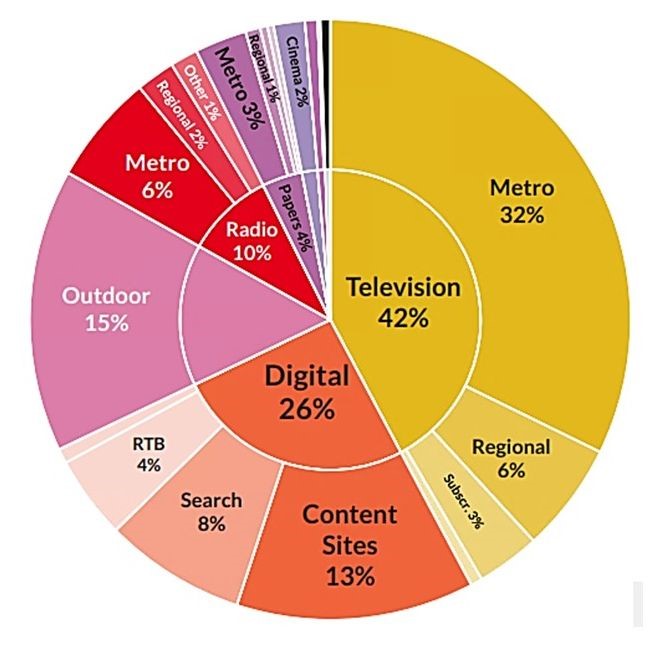

The combination of most of the media offering far more options and time now

spent online has resulted in the enormous audience fragmentation. This audience

fragmentation has also resulted in the ad dollars fragmenting causing a great

deal of pain across traditional media as Digital now accounts for around 30% of

ad revenue. In years gone by Saturday’s SMH attracted people interested in

News, Real Estate, cars and the “rivers of gold” classifieds. These days

realestate.com, carsales, eBay and Seek have taken much of that audience along

with the ad dollars.

From an advertiser’s point of view, it is clearly harder to reach lots of

people quickly making fragmentation a bit of a curse for mass market products.

On the positive side, data is today’s new currency used to spend clients’ money

more wisely and enables more micro targeting of audiences

ACCC vs GOOGLE & FACEBOOK

Last Saturday, the Treasurer’s Office announced the ACCC will publish an

Ad-Tech Inquiry Issues paper in March 2020 – interesting times ahead!

Back

in December 2017 the federal government directed the ACCC to analyse the

Digital Platforms in relation to consumers, journalism and advertising on those

platforms. By ‘platforms’ they basically meant Google and Facebook. The report

came out in June 2019 and we are now getting to the interesting phase of seeing

what can be done.

In

June 2019 the ACCC said they had serious issues relating to market power of

Google & Facebook affecting the media, advertisers, businesses and

particularly consumers. They were scathing of Facebook & Google as well as

the Digital advertising market. The ACCC had particular concerns that consumers

do not realise how much of their data is collected and what is done with it.

They also said the rise of Facebook & Google had caused significant harm to

the news and to journalism. They said “the use of data can exploit behavioural

biases and consumer vulnerabilities on a scale we’ve never seen before”

The

ACCC recommended a branch to be set up within the ACCC to ensure a great deal

more transparency and oversight of Google and Facebook. This branch will

investigate the serious scrutiny of the algorithms of Facebook & Google

which they believe is anti competitive or misleading behaviour. The ACCC also

made a point about the very opaque and unclear Digital advertising market. They

also want an inquiry into the AdTech systems so they can see who is making

money and at what level. The Government has set up new fines and the ACCC

literally said “they were anxious to use new fines in Australia that will

amount to many hundreds of millions of dollars”.

SOCIAL MEDIA

Social media is the

way for people, brands and groups to communicate and interact online. It has

been around for more than 15 years, but lately we have a seen a surge in both

the number and popularity of social media platforms such as TikTok, Lasso &

Vero.

Social media got its name because users are able to engage with each other in

the form of user generated content, commentaries and many more functionalities

that platforms offer nowadays.

For businesses, a rise in social media brings both opportunity and

responsibility with the amount of data & accessibility that marketers have.

Social Media is an important pillar of Digital marketing and it helps brands

accomplish the following goals;

• Community building

& brand engagement :

o Making it easier for brands to talk and address their audiences

o Brands can now more easily announce new products and business developments to

their audience

o Promote events and increase both registrations and attendance

• Brand awareness

& discovery

o Brands can now build awareness through social media with organic social and

paid ads

o With social media it has become easier to discover a brand – through friends

recommendations, influencers and ads

• Websites traffic

& sales

o Increasing site traffic, driving leads and sales as a result of organic

social activity and ads.

Below are the top Social platforms in Australia by number of monthly Unique

Users (source Nielsen Dec 2019):

Facebook: 17,834,000

Instagram: 12,484,000

LinkedIn: 9,679,000

Twitter: 8,365,000

Pinterest: 7,171,000

All the major social networks offer paid advertising options. Social media

advertising allows brands to reach a wider audience than those who are

following them. The advertising options are ever evolving on Social platforms

and they include demographics and detailed targeting options with variety ad

formats to reach your desired audience and achieve your brand goals.

SMI UPDATE – JANUARY 2020

January is

traditionally the smallest ad spending month in Australia so the figures never

look that great. The interim January figures have just been released and it

looks like we are kicking off 2020 the same way we ended 2019 – a negative year

on year performance. The January figures are approximately 10% down compared to

January 2019. This excludes the Digital bookings although once the Digital

bookings are added we expect to still be in the negative.

The Automotive and Retail categories continue to be in the ‘Top Declines’ for

the month. Perhaps not surprising given the bushfires, Travel spend was also

down. All the media are down although the one spot of good news was Street

Furniture had a substantial increase from January 2019

1. A 30 sec TV ad in

the 2020 Super Bowl was around $5.6million USD

2. More than $500 billion a year is spent on advertising worldwide

3. 4 million Australians aged 14+ (19.1%) now use meal delivery services, up

from 1.98 million (9.8%) Interestingly ‘Food Delivery Services’ advertising has

grown 4 fold since 2016 to $42 mil in 2019

4. Only 12% of Australians expect 2020 to be better than 2019. This puts us

43rd of 47 countries … at least we’re more positive than Italy (11%), Jordan

(7%) and Lebanon (5%) – Roy Morgan