THE COOKIE BURNOUT

Given around 40-50% of every advertising dollar is spent online, the impending ‘cookie-less’ world (14 months from now) is a substantial issue facing the industry. A ‘cookie’ is a small piece of data stored on the user’s computer by the web browser when a user visits a website. We all use browsers (Google Chrome, Firefox, Safari, etc, etc) to navigate the World Wide Web and each time we go to a website the browser keeps that information stored. Up until now, cookies have played a major role in digital targeting, measurement and strategy.

Technically there are 1st party cookies which are set by site publishers once you visit and then there are 3rd party cookies which is what is being phased out. The 3rd party cookies are valuable as they keep track of a user’s history across the entire internet. The 1st party cookies track users across the publishers own sites and not where else they go.

Losing the 3rd party cookies, without an alternative, means advertisers will find it more difficult to;

- retarget consumers once they’ve left their website

- have information on users interests outside their own website

- attribute ROI outside of the website the user clicked on

- prospect customers across display and video activity

- determine reach & frequency or use frequency caps

3rd party cookies have already been limited on the Safari browser (default for Apple) and Firefox. The Chrome browser representing 50%+ of all internet traffic, will follow and progressively block cookies on its users between now and 2022. Impressions, clicks & views will still be accurate but won’t deliver the same insights. For example, 5,000 weekly impressions could be 5 impressions to 1,000 people or 1,000 impressions to 5 people. For ‘Clicks’, the only attribution modelling you could do would be based on ‘last click’ attribution. Last clicks have been proven to have very low to no correlation with ad effectiveness for nearly 20 years. The race is now on to find an alternative to tracking behaviour on the internet.

Perhaps the biggest reason an alternative will be found is it is financially advantageous to Publishers. Simply put, a Publisher can charge 4 times as much for a targeted / specific audience (measured by 3rd party cookies) than it can for a unmeasured ‘thousand impacts’.

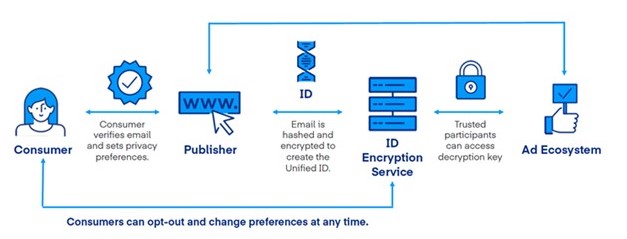

As you can imagine numerous digital players are currently working on a solution to prepare for a cookie less world. The Trade Desk is partnering with IAB, NAI and ANA to list a few in replacing cookies by another form of unified ID across the web. The Trade Desk is proposing consumers log into websites using their email and at the same time set their privacy preferences. These email addresses are then hashed and encrypted and will replace the cookie with a new common language for the ad tech industry. This ID Encryption Service will help provide a layer of security, accountability and consumer control that cookies presently don’t provide. The tracking effectively moves from browsers and onto people’s email & device ID. The diagram below best explains The Trade Desk’s proposal.

If you want to understand more about the implications of a cookie less world, the following link from the IAB Australia is an informative read. https://iabaustralia.com.au/resource/beyond-the-cookie-mapping-the-future-of-marketing-measurement/

WHAT’S NEW IN MEDIA – CH10 ‘SHAKEING’ UP TV

Ch10 launched the latest free to air TV station on Sunday 27th September and it’s called ‘10 Shake’. It is Ten’s 3rd digital station (after 10 Peach & 10 Bold) while Seven has 3 ‘digi’ stations (7mate, 7two, 7Flix) and Nine has 4 (9Go!, 9Gem, 9Life & 9Rush).

This new station has its origins in the CBS purchase of Ch10. CBS (now ViacomCBS) owns MTV, Nickelodeon & Nick Jnr and Ten has recently been selling advertising on those stations even though they appear on the Foxtel platform. Network 10 has the highest percentage of an ‘under 50’ audience (42%) and they say 10 Shake completes their Under 50 dominance.

10 Shake daytime programs will be for kids (SpongeBob SquarePants, PAW Patrol, Dora The Explorer, etc) while night time will be focussed on “big kids” (Teen Mom Australia, Comedy Central Roasts, Drunk History US, Lip Sync Battle, etc).

As kids programs attract very little advertising dollars it’s reasonable to ask why start a station dedicated to kids? Perhaps this is just a good way to launch 10’s fourth station with content that comes very cheaply for them and reinforces their youth appeal.

DIGITAL – COVID DRIVES ECOMMERCE!!

Although online shopping was steadily increasing before Covid-19, the effect of Covid has been far more widespread than anyone could have predicted. As bricks and mortar stores were closed, Australian ecommerce boomed with 5.1 million households shopping online in the month of April. Year on year, ecommerce has increased over 80%. In 2019, 1.6 million households bought something online each week while in April 2020 that figure rose to 2.5 million households each week. By the end of 2020, ecommerce is estimated to account for 15% of the total retail market (excl. cafes, restaurants & take away).

The early adopters of online shopping primarily wanted cheaper goods although the post Covid online shopper could represent the rise of the convenience shopper, less price conscious and keener on customer service. They want it to be hassle free and for the items to arrive quickly. The unprecedented rise in recent months has shifted consumer behaviour to a stronger reliance on technology to undertake everyday activities, as well as a change in Brand Loyalty as many customers in lockdown were forced to buy through necessity rather than preference. The rise of the ‘Buy Now Pay Later’ services has also played its part by providing consumers with more affordable ways of purchasing online items. Interestingly the time of day for online sales has been spread out a bit more since Covid although the 7-10pm and 2-5pm areas still make up 50% of all the purchase times.

Retailers have the unique opportunity of capturing this ever increasing online shopper if they can set up efficiently for ecommerce. A growing consumer base with an increased confidence in online shopping is now available, making this a perfect time to introduce ecommerce into your business if you haven’t done so already.

SMI UPDATE – AUGUST 2020

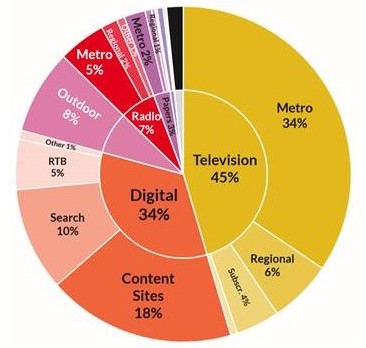

As they say, everything is relative in life. Although the August advertising spend is down by 17.2%, it is being touted as a good result despite it being the 5th worst result since 2007 when SMI started,. Probably because the 4 largest declines of all time occurred in the previous 4 months (Apr-Jul’20). Therefore, August is seen as the media agency market continuing to recover after Covid wreaked havoc on client’s advertising spend.

The Digital media reported the most resilient result with bookings back just 4.7% as both the Social Media (+30.6%) and Pure Play Video Sites (+28.7%) sectors delivered strong growth. TV also reported a solid result (-11%) with the Metropolitan TV market delivering the smallest YOY decline of 10.7%. The recovery is underscored by the fact that more than a quarter of all SMI Product Categories reported higher media investment in August. Supermarkets, Health Insurance, Government, Health Care, Household Cleaning Products and Smartphones all delivered double digit growth, while Bank Brand/Sponsorship lifted 8%.

FAST FACTS

- It is impossible to break an egg held end to end with one hand.

- Ch7 have re-secured FTA TV rights for Supercars for 2021–2025 after a 6 year break

- The top 1% of the world now owns 50.1% of the world’s wealth

- Black Friday (27/11) and Cyber Monday (30/11) saw a 34% year-on-year growth in online purchases in Australia in 2019

- Queen Elizabeth II is a trained truck mechanic and driver

- Aug’20 Retail spend is up 7.1% compared to Aug’19 (ABS)