THAT’S NOT A KNIFE, THIS IS A KNIFE!!

This week Facebook came out swinging (in the NY Times) against the ACCC’s draft code in what is looking to become quite a fight with the Australian Government.

In a nutshell, the code will force Google & Facebook to pay Australian media companies (predominantly News Ltd & Nine) for using their news stories. Although this is local, it is seen as a test case for the world and has the potential to be adopted globally which is probably why Facebook announced their response in New York. Remember Australia leading the way with plain packaging cigarettes? As you would expect, there is an enormous amount of dollars at stake and potentially intellectual property for the tech companies. The consultation with the stakeholders finished last Friday so the next step is the release of final ACCC code. Facebook said it will stop the sharing of local and international news on Facebook & Instagram while Google says it won’t be able to guarantee relevant articles on Google Search & YouTube.

Back to what’s at stake? News Ltd have said it is worth $1 billion however Google is talking about a $10 million figure. Only a $990 million difference in opinion! Presently the code gets each party to enter negotiations and nominate a dollar figure for what they believe the news content is worth. After 3 months of negotiations, each party submits a bid figure and an arbitration panel selects one of those figures that both parties must abide with. This makes it dangerous for either party to shoot too high or too low as they could potentially drive the panel to select the other’s bid. After 3 months of discussions and negotiations we assume the difference will be smaller than $990 million.

As a mechanism to resolve a dispute, the code looks to be quite clever however perhaps the real question is why is it being proposed. The ACCC Chair, Rod Sims, said “there is a fundamental bargaining power imbalance between news media businesses and the major digital platforms, partly because news businesses have no option but to deal with the platforms, and have had little ability to negotiate over payment for their content or other issues”. The tech giants say they are a benefit to the companies as they send traffic to the news sites (2.3 billion clicks sent to Australian news sites from Jan-May 2020). While the news companies say the clicks are worthless as there is no data behind them and they can’t be sold to advertisers. So that still leaves the question of how much benefit is Google and Facebook gaining from the news stories. Only about 4% of Facebook’s News Feed is actually “news,” as opposed to posts from family and friends, while Google doesn’t monetize Google News and says that only about 1% of searches in Australia have anything to do with current events.

The code only targets Google & Facebook (no mention of LinkedIn or Twitter) and for Australian media companies it excludes the ABC & SBS and any small companies with less than $150,000 revenue. The code also requires the tech giants to share algorithm changes and details on user data with the news companies. While the arbitration panel is told it must consider the direct and indirect benefits (whether monetary or otherwise) to Google & Facebook. That does seem to be quite a vague way of determining ‘value’.

There is no doubt the news companies have suffered since the ’rivers of gold’ classifieds, job ads and car sales migrated to the internet and it is good to see Government trying to ‘balance the power’. The news stories on Facebook and Google do enhance the consumer experience and deliver more data to the tech companies however the question around how they monetise that is highly contentious. This will be fascinating to see how it plays out and who comes up with the bigger knife.

WHAT’S NEW IN MEDIA – “COVID” RATES COMING TO AN END

Covid greatly affected the media from April – June 2020 and therefore they had little demand and lots of supply. A great time to be buying advertising … if you were fortunate enough to be in that position. In addition to that, most of the media, except Outdoor and Cinema, had increased consumption which again made it a very opportune time to get tremendous advertising exposure.

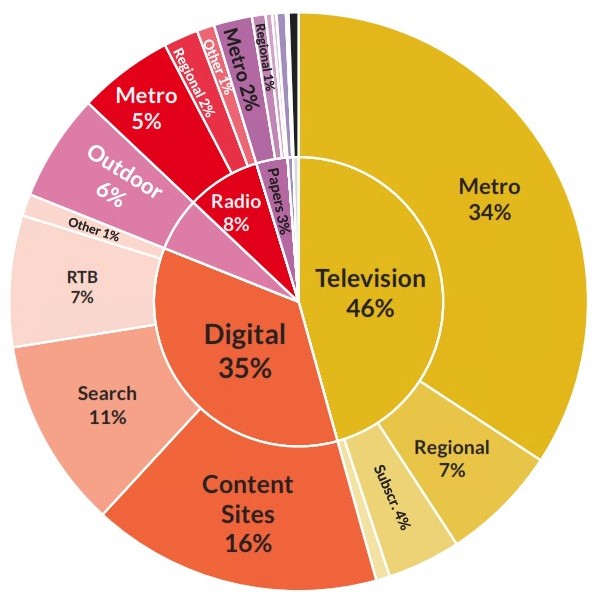

Looking at the latest SMI figures it is clear to see increasing advertising spend across most media. In particular, Television and Digital are in a substantially better positions than they were in May. Television’s demand has grown around 50% from May meaning their ‘availabilities’ have dwindled and it is now difficult to buy short term. TV buys now need to be done 4-5 weeks out to get the programs you want. Digital is somewhat less clear to see the ‘Covid’ benefits as much of it is auction based and ‘supply’ never seems to be too much of an issue. The ‘direct’ buys with particular websites have seen some good deals.

The Oct-Dec run up to Christmas period is invariably in high demand and even in this Covid year we expect that to continue. There are absolutely still great opportunities to be had however they are possibly more likely to be in Radio, Outdoor, Cinema and Print where supply & demand works in favour of the advertiser.

DIGITAL – CLOSING THE OFFLINE & ONLINE SCREEN DIVIDE

Samba TV (https://samba.tv/) is a global technology company gathering TV viewership from users that voluntarily opt-in on their smart TVs (via the settings). They have deals with many TV brands including Sony, Sharp, TCL and Philips and have access to 35 million smart TV sets in the US and globally. The adoption is increasing in Australia with around 100,000 TV sets to date.

The exciting news is that Samba TV has recently partnered with 2 programmatic leaders, The Trade Desk and MiQ, to allow advertisers to target an audience across multiple screens (TV, desktop, mobile, etc). This allows advertisers to follow an audience across linear TV, streaming services, Foxtel and video programmatic activity. This presents opportunities for media planning as we will be able to control the frequency / exposure of the advertising across multiple screens. Samba also determines exactly what has appeared on the screens so we could also target an audience that has specifically seen competitors advertising.

For marketers, this unlocks unprecedented access and bridges the gap between digital and offline screen targeting further.

So why would anyone want to opt-in to Samba TV? The main attraction resides in the personalisation of their TV viewership allowing them to get tailored program recommendations (similar to Netflix).

In the months to come (Q4 2020 TBC), the targeting options will increase with the ability to target users based on specific program viewership or their watching behaviour (light viewers, tv bingers etc.).

The long awaited promise of fluid offline and online screen integration is getting closer!

SMI UPDATE – JULY 2020

The latest SMI data is moderately good news as it is the lowest decline (-28.4%) since March. At this stage, the month of August is also looking better again. The 12mth year on year comparison shows the Australian ad spend is down-16.2%.

July was an improvement for Radio (-29%) but unfortunately Outdoor continued to have the highest decline at -66%. TV (-23%) and Digital (-16%) continued to improve their advertising income as did Newspapers at -38% and Magazines at -60%. Despite Cinemas opening again in July the ad revenue was slow to follow although the closure of Victoria did not do them any favours. On a positive note, Cinema has a lot of ‘blockbusters’ to cram into their schedule between now and Christmas. ‘Reail’ is the second largest category and the good news is it is beginning to stabilise and was only down -3.8% compared to July’19. The bad news is that the largest category, Auto, was down the most at -52%. Perhaps the stockpiling of toilet rolls has run out as ‘Toiletries / Cosmetics’ was up +21% and of course the Government continued to increase their spend with a +38% increase

FAST FACTS

- Australians spend about $1.36 billion on Mother’s Day and $660 million on Father’s Day

- Every adult human contains 1-4 kg of bacteria – we may need bigger face masks

- 85% of SMB’s had an average fall in revenue of 42% comparing Jan-Jun’20 to Jan-Jun’19. (AANA survey)

- On average, your heart has beaten 400 times in the 5 minutes it has taken you to read Pearman Pulse

- In the last 4 weeks, 19 million Australians have gone to Google and 17.5 million to Facebook (Morgan Mar20)

- Two-thirds of all US $100 bills are held outside the USA